osceola county property tax rate

Irlo Bronson Memorial Hwy. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Run a Business Tax report Run a Real Estate report Get bills by email.

Osceola County Fl Property Tax Search And Records Propertyshark

Osceola County Florida Osceola Countys overall proposed tax rate will remain at 82308 mils for the general fund EMS.

. The median property tax on a 19920000 house is 209160 in the United States. If you did not own the tangible personal property before January 1 2021 please contact the Property Appraisers office at 407 742-5000. The median property tax on a 19920000 house is 193224 in Florida.

If you are contemplating taking up residence there or only planning to invest in Osceola County property youll learn whether the countys property tax laws are helpful for. Karthik saved 38595 on his property taxes. OSCEOLA COUNTY TAX COLLECTOR.

407-742-3995 Driver License Tag FAX. When added together the property tax burden all taxpayers support is created. In this basic budgetary function county and.

This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar. Search all services we offer. OSCEOLA COUNTY TAX COLLECTOR.

With market values established Osceola along with other in-county public bodies will calculate tax rates independently. Property Appraisers Office 2505 E Irlo Bronson Memorial Hwy Kissimmee FL 34744. 407-742-4037 Property Taxes FAX.

Officials signed off on. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Run a Business Tax report Run a Real Estate report Get bills by email Cart. Mill rate assessed value exemtion amount taxable value taxes levied rate units amount non-ad valorem assesments combined taxes and assesments if paid by please pay nov.

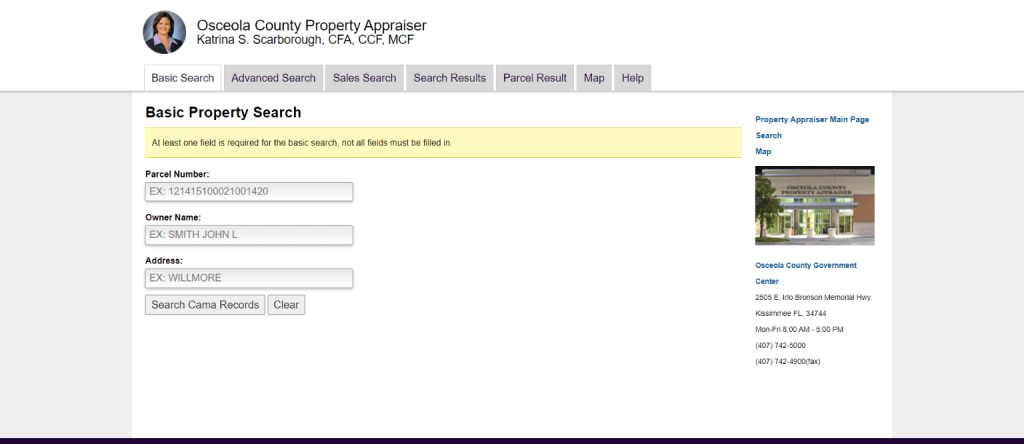

Osceola County Florida Property Search. Tonia Hartline 301 W. Property owners are required to pay property taxes on.

The property tax rate is typically given as a percentage expressed as a per mil amount of tax per thousand currency units of property value. Economic Development Commission 300 7th Street Sibley Iowa 51249 712 754-2523. I had a fantastic experience getting my property tax deal processed through TaxProper.

OSCEOLA COUNTY TAX COLLECTOR. Osceola County Clerk of the Circuit Court Kelvin Soto 2 Courthouse Square Kissimmee Florida 34741 407 742-3500. Taxpayers may choose to pay their property taxes quarterly by participating in an installment payment plan.

Osceola Tax Collector Website. Osceola County commissioners voted this week to propose a flat property tax rate for the 12th-straight year according to a news release. With this resource you will learn helpful knowledge about Osceola County property taxes and get a better understanding of things to consider when it is time to pay.

The Tax Collectors Office provides the following services. Osceola County Courthouse 300 7th Street Sibley Iowa 51249 712 754-2241. To calculate the property tax multiply the assessed value by the.

If you do not want your e-mail address released in response to a public records request do not send electronic mail to this entity. Delinquent Tax Online Payment Service. TANGIBLE PERSONAL PROPERTY If you received a Tangible Personal Property Tax Notice for property you owned on January 1 2021 but no longer own you are still responsible for paying the taxes.

Visit their website for more information. TaxProper did a great job answering any questions I had about the process and their service. 407-742-3995 Driver License Tag FAX.

407-742-4009 Local BusinessTourist Tax BRUCE VICKERS CFC CFBTO ELC. In Michigan Osceola County is ranked 13th of 83. 2017 tax bill information bruce vickers cfc tax collector 2017 osceola county property tax.

407-742-4037 Property Taxes FAX. The process was simple and uncomplicated. To be eligible for the program the taxpayers estimated taxes must be in excess of 10000.

The median property tax also known as real estate tax in Osceola County is 188700 per year based on a median home value of 19920000 and a median effective property tax rate of 095 of property value. The median property tax on a 19920000 house is 189240 in Osceola County. Search Use the search critera below to begin searching for your record.

Irlo Bronson Memorial Hwy. There are 2 Assessor Offices in Osceola County Michigan serving a population of 23221 people in an area of 567 square milesThere is 1 Assessor Office per 11610 people and 1 Assessor Office per 283 square miles. I would recommend them anytime for tax appeal needs.

Under Florida law e-mail addresses are public records. View more property details sales history and Zestimate data on Zillow.

Property Tax Search Taxsys Osceola County Tax Collector

Osceola County Florida Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Osceola County Ordinance 00 13 Indian Wells Hoa

How To Pay Osceola County Tourist Tax For Vacation Rentals

Osceola County Property Appraiser How To Check Your Property S Value

Osceola County Fl Property Tax Search And Records Propertyshark

Osceola County Florida Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

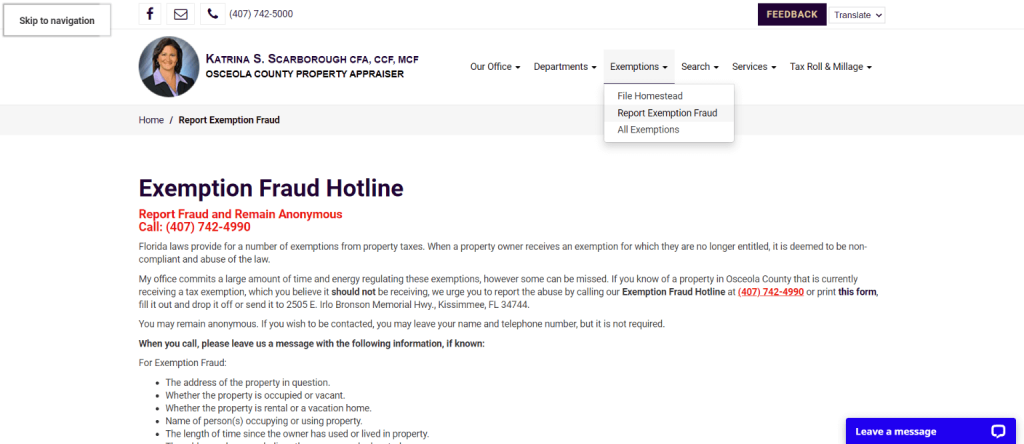

Osceola County Property Appraiser Katrina S Scarborough Cfa Ccf Mcf

Meet The Candidates Here S Who S Running For Osceola County Property Appraiser

David Weekly Townhouse Home Owners Association Fees In Spring Lake Celebration Fl Spring Lake Lake Garden Celebration Fl

Osceola County Florida Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Osceola County Property Appraiser How To Check Your Property S Value

Osceola County Florida Application For Osceola County Local Business Tax Receipt Form Download Fillable Pdf Templateroller

Osceola County Property Appraiser Katrina S Scarborough Cfa Ccf Mcf